One of the best things about Spendge is the transparent transaction process, users can see every stage of their transactions in their personal account. By providing visibility into the payment lifecycle Spendge gives users the security and full control over their own accounts, balances and financials.

What is Spendge?

- Spendge is a service of virtual cards and payments for webmasters, marketing agencies and media buying teams.

- Users can issue unlimited virtual cards in 3 currencies (USD, EUR, and GBP) with multiple functions to simplify the payment process. Spendge’s virtual cards are optimized for various digital ad channels like Facebook, Google and TikTok, perfect for businesses that use popular ad platforms.

- Spendge is for marketers to simplify the payment flow and speed up.

- The service has a transparent transaction process, users can see every stage in their personal account.

- Spendge is okay for simplifying payments and speeding up.

How Does Spendge Work?

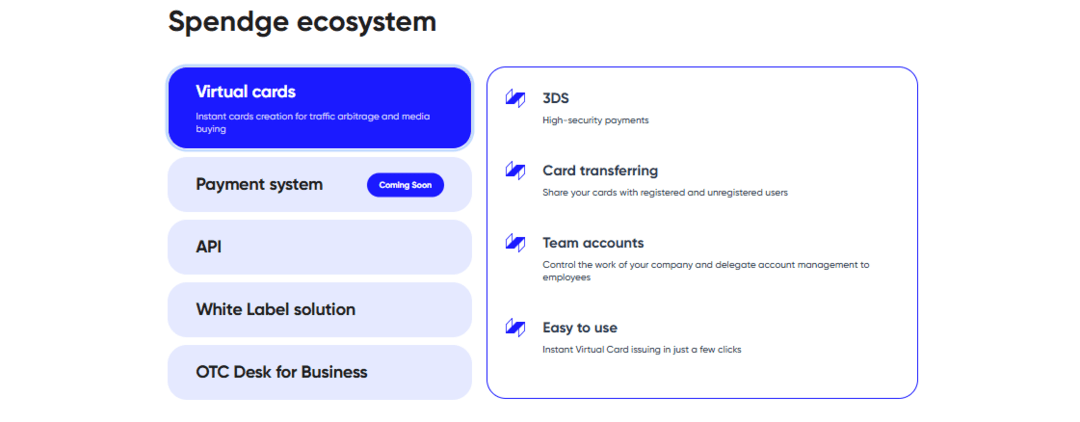

Spendge is designed to simplify the payment process for webmasters, marketing agencies and media buying teams through its virtual card, system and payment service. Users can create and issue virtual cards in 3 major currencies: USD, EUR and GBP, to manage international transactions. The platform has multiple functions to support and simplify payments, with features like instant virtual card issuance, crypto invoices and cross-currency transactions.

Getting started with Spendge is easy. Users need to sign up for an account and provide personal information like name, surname and Telegram contact for the support team. Once the spendge account is set up users can top up their Spendge account with the desired currency and add slots, which are opportunities to issue cards. Creating a new card is as simple as filling in the required details like number of cards, BIN, owner name, comment and title.

Spendge ensures complete anonymity and security for all transactions made with corporate Visa cards and team using accounts. The platform also offers many benefits fair cashback rewards and low rates for topping up the team or Spendge account balance by using Crypto and Wires. Spendge also provides advanced analytics and reporting for all corporate visa cards and team spending accounts, so users can track transactions, monitor balances and get valuable insights into their team’s spending habits.

Benefits of using Spendge for Marketing

Card Integration

Spendge has optimized cards that integrate with major ad platforms like Facebook, Google, TikTok and other popular ad platforms. This service is perfect for marketing teams that need the ability to allocate funds fast and efficiently across multiple channels without worrying about compatibility or security issues.

Unrestricted Spend

With Spendge users are not limited by spending limits, unlimited amount limits, credit amount limits, balance due limits, card issuance limits and unrestricted spend limits. This is a big plus for marketers who need flexibility and the ability to create and adjust budgets on the fly.

Secure

Security is top priority for Spendge, it provides secure transactions with complete anonymity and protection of sensitive financial data and information. This is important for businesses that need to keep things confidential and secure when managing customer accounts and partner’s finances.

Cost Effective

Spendge has low rates and fair cashback rewards for top up and balance, top ups, balance and spend, so it’s a cost effective solution for businesses that want to optimize revenue and balance their marketing spend. Ability to manage and balance balances across multiple cards and accounts at the same time makes budgeting and spending even more efficient.

Security and Convenience with Virtual Cards

Spendge has high-security payments and card balance transferring services, balance and other balance sharing services with registered partners and unregistered users. Also the service has crypto invoices, so users can accept and send payments from global customers and partners without costs and expand business and revenue.

- Cross currency transactions allows marketers to transfer money between different currencies within the platform.

- Spendge has complete anonymity and protection of sensitive financial information.

- The service has fair cashback rewards for top ups and spend.

Cross-Currency Transactions

Another cool feature is the cross currency money transaction, marketers can manage money across different currencies within the platform. This feature not only makes international money transfer easy but also gives you an edge in the global market.

Complete Anonymity

Spendge has promised complete anonymity, security and protection for sensitive financial data, so all transactions where customers spend it will be secure. This service is perfect for businesses that prioritize data security, privacy and security.

Spendge and Federal Spending: A Solution for Government Agencies

Spendge’s virtual card and payment service is not just a great opportunity for marketers; it can also be a game changer for government agencies that want to streamline and track their federal spending. The budget feature allows users to manage their spend power and allocate funds to different projects and initiatives. With Spendge’s personal account feature, government agencies can track their spend and manage their federal budget securely and transparently.

AlienCPA recommended —

ODYS Global Review: Unlocking the Power of Aged Domains

The support team at Spendge is available to help government agencies with their spend and support team needs, to guide and support them on how to use the platform to optimize their federal and team office spend and support team. The object class feature allows government agencies to categorize their and team spend by object class, so they can track and manage their federal and team expenses.Spendge’s virtual cards, funds, services, funds and accounts can be used for national security spending power, defense spending power, and social security spending power, so government agencies can move funds and pay securely and efficiently. The crypto invoices feature also allows government agencies to accept and send payments from customers and partners around the world, so they can manage their finances and federal spend easily.

In general Spendge’s virtual card and payment system is a solution for government agencies that want to streamline and track their finances of their federal revenue and spend accounts to track costs and optimize their revenue and budget.

FAQ

Q: What is Spendge?

A: Spendge is a virtual front office system, accounts, card and payment service to track costs and simplify financial operations for webmasters team, marketing agencies partners and media buying teams. It has unlimited virtual front office, accounts and card issuance in USD, EUR and GBP.

Q: How does Spendge optimize marketing?

A: Spendge integrates with major ad platforms, has no spending limits, secure transactions and cost effective revenue side solutions so marketing teams can allocate budget efficiently and spend more.

Q: What security for Spendge users?

A: Spendge has complete anonymity and security services and protects sensitive financial information through secure transactions and security services. It has high secure payments and other security services and options for customers to use funds, transfer money and share cards securely.

Q: Can Spendge do international transactions?

A: Yes, Spendge has cross currency money transaction, users can manage funds in different currencies. This feature makes international money transfer and cost for customers and partners and supports global business growth.

Q: Are there any rewards for Spendge?

A: Spendge has the benefits of fair cashback rewards for top up, top up and top up top up top up top-ups of accounts and spend, so it’s a cost effective solution for businesses to optimize their marketing budget.

Q: What is OTC Desk in Spendge?

A: OTC Desk is a full service feature that allows users to buy and sell cryptocurrencies directly with Spendge. It has competitive rates, secure transactions, full support team and easy to use interface to manage crypto investments.

Summary

Spendge is a solution for affiliates, webmasters and marketing professionals to simplify their financial operations with virtual cards. It’s convenient, secure and cost effective so it’s a good choice for those who want to optimize their marketing. Join Spendge and create your own virtual card and see for yourself. Whether you want to streamline your payment or expand your marketing reach, Spendge has got you covered, enjoy low rates.